Consistently Strong

Armed with peer-recognized legal skill and excellence (our roster includes three Board certified bankruptcy specialists and Super Lawyers honorees), Allen, Jones & Giles is a consistently strong match for the bankruptcy departments of national and regional law firms in complex bankruptcy and loan workout matters.

From our offices in central Phoenix (right), Yuma, Prescott, and Columbus we offer the agility, value, and advocacy you expect from a seasoned, effective bankruptcy focused law firm, offering experienced advocacy on behalf of borrowers, creditors, and other parties in major industries, including those listed below.

Allen, Jones & Giles, PLC, has been named a Tier 1 firm in Metropolitan Phoenix for Bankruptcy and Creditor Debtor Rights, and Insolvency and Reorganization Law and a Tier 1 firm in Metropolitan Phoenix for Litigation - Bankruptcy by Best Lawyers® “Best Law Firms” in 2026.

Need help with complex tax issues?

Our firm has substantial experience handling tax-driven bankruptcy filings and related litigation with the IRS. We regularly represent individuals and businesses in cases involving complex tax issues, dischargeability disputes, and structured resolutions of significant tax liabilities—regularly with millions of dollars at stake.

Industry-Specific Experience

Construction

Real Estate Development

Healthcare

Transportation

Restaurant & Retail

Manufacturing & Distribution

Banking & Finance

Hospitality

Agribusiness & Livestock

Energy

Telecommunications

Technology

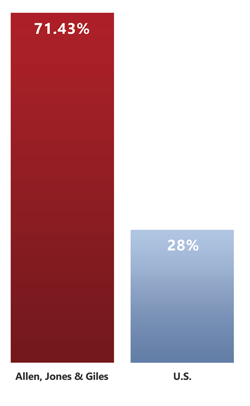

A Chapter 11 Plan Confirmation Success Rate Over Twice the National Average

As last calculated, the national average for confirmed Chapter 11 plans was 28%. In contrast, since 1999, Allen, Jones & Giles has more than doubled that success rate, achieving confirmation of over 70% of its clients' Chapter 11 plans.

This plan confirmation rate is based on Allen, Jones & Giles's current attorneys’ success in bankruptcy cases filed by the firm from January 1999 through October 2019 (only including closed cases and only the lead case in jointly administered cases). The 28% national average referenced above is for Chapter 11 cases from 2008-15 and is the most recent period in which a study of national Chapter 11 plan confirmations rates is available. See Ed Flynn, “Chapter 11 Is for Individuals and Small Business?" American Bankruptcy Institute (December 2018). Past results are not a guarantee of future success.